This is a January 2023 Market Update. If you like this kind of information, be sure to like, share, and follow as I will be sharing more informative videos about the real estate market, as well as home selling and home buying tips!

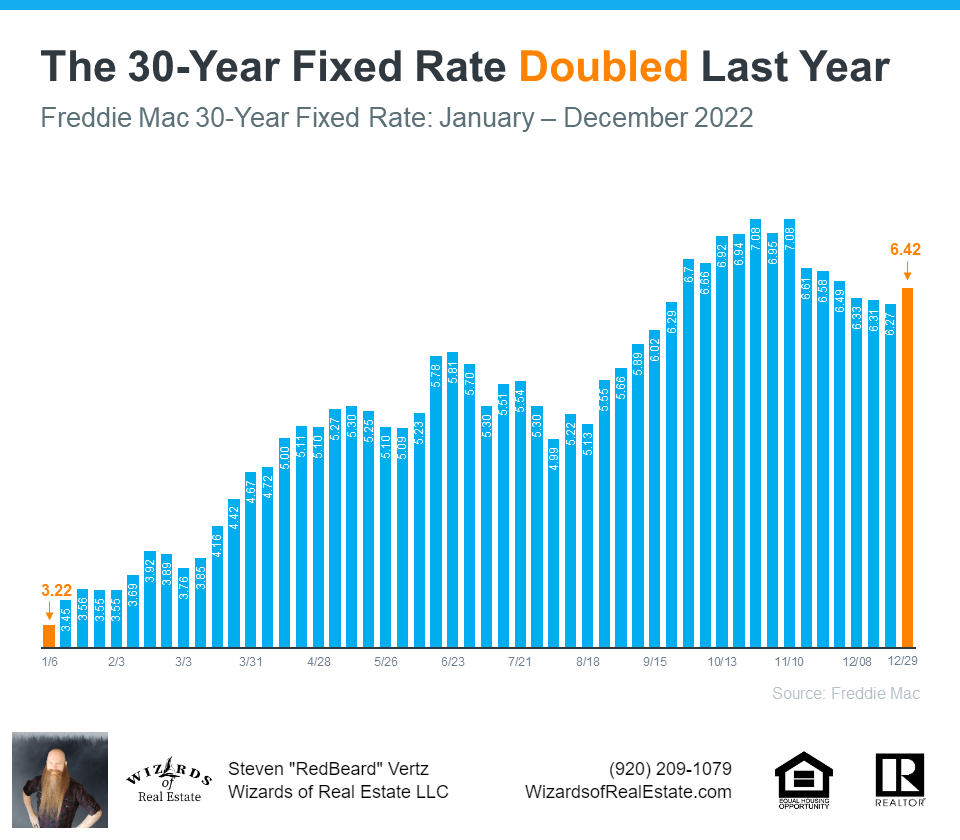

Now I want to start off with the reality of 2022, and that is that the 30-year fixed rate in this country doubled over the last year. We started out at around 3.2% back in January a year ago, and we ended up right at around 6.4% as we wrapped up the year.

While some were predicting that the market would see interest rates possibly up to the 9 or 10%, I predicted earlier in the year that they wouldn’t pass 8%, and would most likely stay between 6-7% and possibly a bit over 7% by Fall….which is exactly what happened.

Keep in mind that we have never seen a year where the mortgage rates rose so quickly or where the mortgage rate doubled!!! All of that certainly has impacted the market. It has had a psychological effect across the nation… I think one of my jobs right now is to help you understand what is happening.

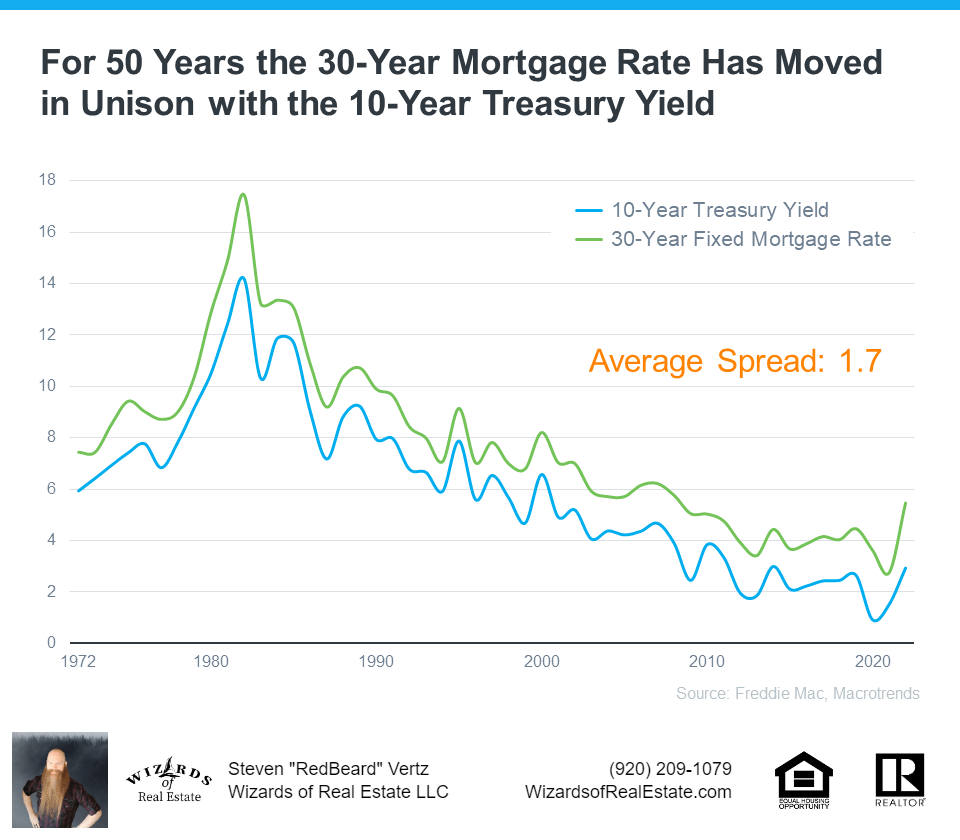

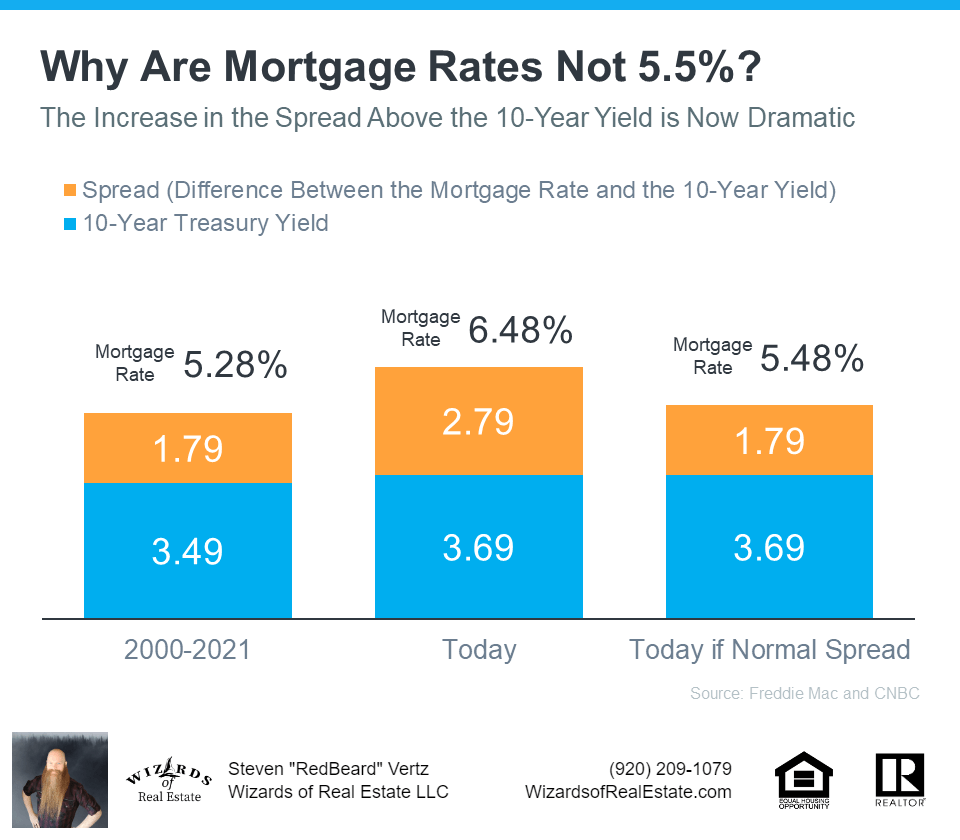

Now, If we go back over the past 21 years, we see the average 10-year treasury was hovering around 3.49%.

The spread there, about 1.79%, giving us an average mortgage rate of 5.28%.

So, you take the treasury, you add 1.79%, and you get the average mortgage rate.

That spread rose where the 10-year treasury hit 4.02% in October and then back down to , 3.52% for this past January.

So the spread was over 2.5%, and national average interest rates can be seen a bit over 6% now.

As we see that spread decrease, we will see lower mortgage rates.

And if the spread were normal today, we'd see an interest rate of just under 5.5%. So there is a good chance that the interest rates will be between that 5-6%, but unlikely to dip under that 5%.

The good news is that panic has been subsiding, which also means it is good news for long-term interest rates!

The 1st part of the year we saw people getting more uncertain about the economy, things happening, and panic entering into the equation.

Around June of last year, the Feds came out and said, "We don't have this under control. We want to reset the housing market."

We then saw the panic go up again… And then we come to the end of this past year, and we start to see the panic subsiding and the Feds then saying, "Maybe the peak of inflation is behind us."

Lawrence Yun stated,

“The upcoming months should see a return of buyers as mortgage rates appear to have already peaked and have been coming down since mid-November.”

One of the premier thinkers in the mortgage business, Dave Stevens, former Assistant Secretary of Housing, who also held positions at the MBA, said,

"So be advised, this may be the one and only window for the next few years to get into a buyers’ market. And remember, as Federal Reserve data shows, home prices only go up and always recover from recessions no matter how mild or severe. Long-term homeowners should view this market right now as a unique buying opportunity.”

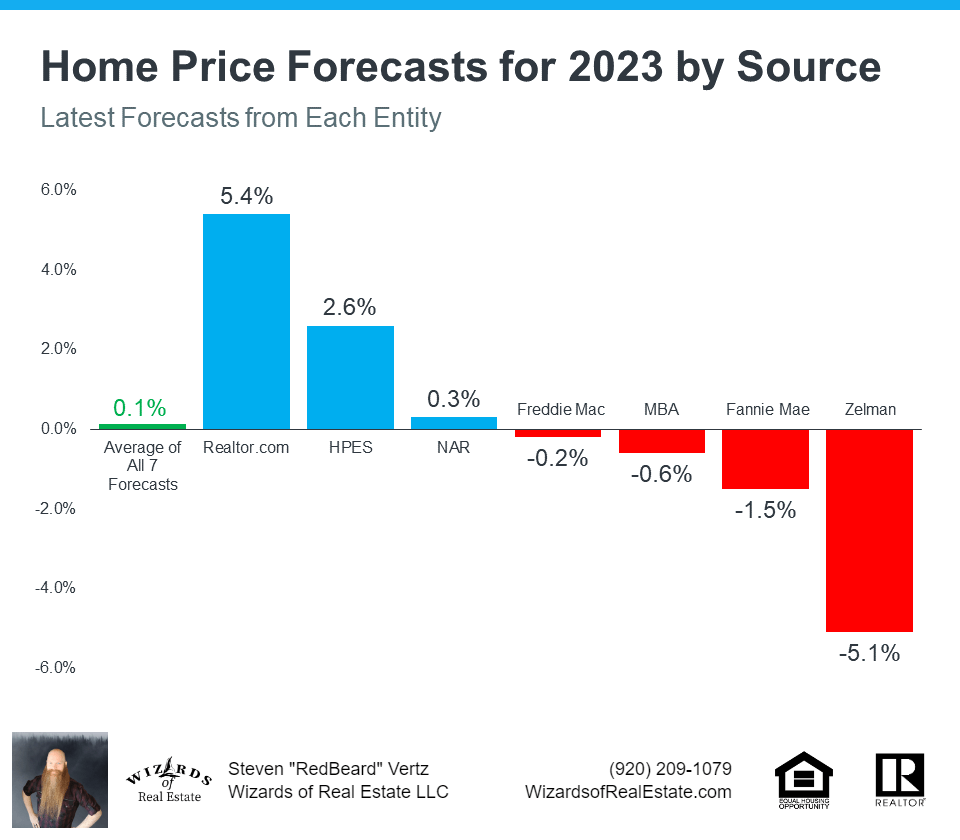

First, the one thing that is true right now about forecast for home prices is none of the experts agree. That is absolutely true. This is a look at the forecasters that we follow.

They go anywhere from depreciation of 5% to appreciation of 5%. The important thing to remember right here is that we don't see any of these reputable forecasters calling for a free fall in prices in the housing market. I have been telling people for over a year now that the appreciation should continue, but more to a back to normal range of around that 3% to maybe 5% for 2023… instead of the skyrocketed appreciation we saw in the past couple years.

One of the interesting things that has been published recently was an article in the Wall Street Journal where they looked at home price appreciation before the pandemic and after the pandemic. If you look at before the pandemic from the fall of 2017 up until the spring of 2020, there’s about a 12% home price appreciation in that two and a half year time span. If you think about the two and a half years going into this fall since the beginning of the pandemic, what did we see?

There is a tremendous amount of appreciation across this country in residential real estate, 38%. So would it make sense that in some markets and in some cases we would see a little bit of that come back? Absolutely it would. But again, not a free fall in prices like some people in the media, on Facebook, YouTube, and other places like that.

Some people have been saying that every home out there is reducing their price right now, but that is simply not true. The recent information we have from realtor.com from November shows that just If you look at this, the share of homes having their price reduced going all the way back to 2021, let's look at this graphic right here, at the height of the most recent information we have from realtor.com in November was just over 1% of homes having a price reduction in the market. So again, not a free fall, not a situation where we're seeing every home having their prices reduced.

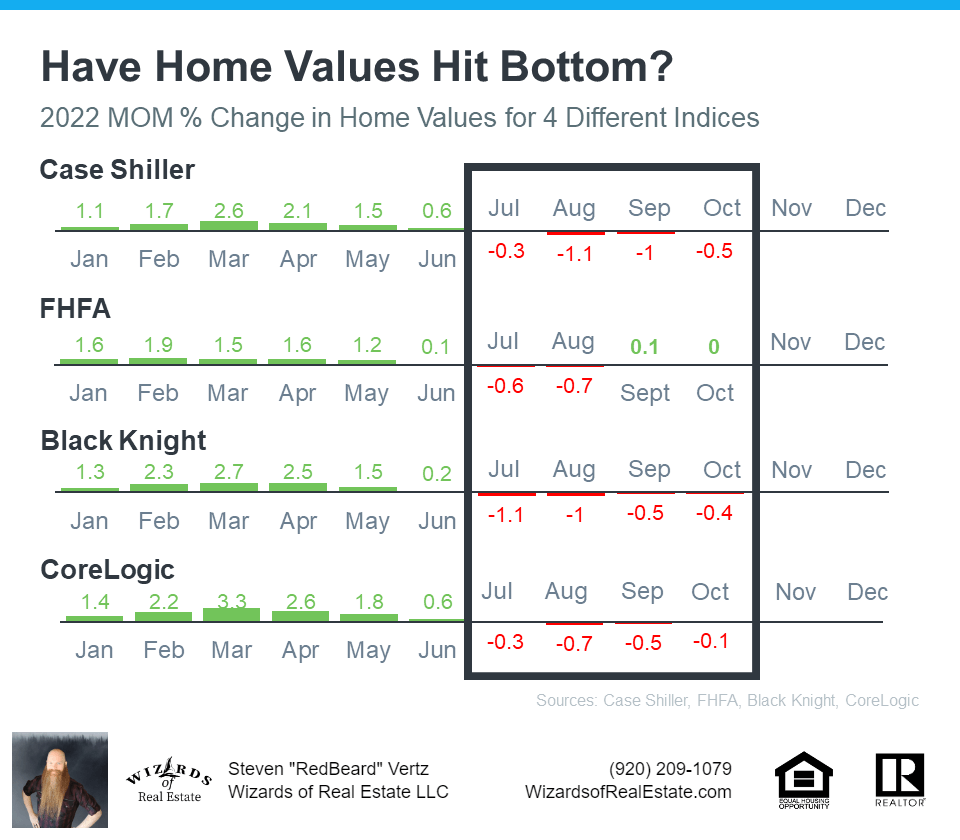

“Have home values hit their bottom?” This is a look right now at Case-Shiller, FHFA, BlackKnight, and CoreLogic in their month-over-month home value change. If you isolate the last four months that have been published, what we see in each case, the depreciation peaked in August.

Now, I'm not here to say that we're out of the woods, but what I am here to say is home price depreciation is not in a free fall.

You're not seeing it drop and continue to drop. May see a little bit here and there coming forward, but not this huge decline in home prices.

Don’t believe all you hear from the media. If you take the December Sales Report, you can see that over 11,000 homes sell every day in this country.

The proof of that is the math on the screen, just over four million homes in the existing home sales report, divided by 365 is just over 11,000 homes every day. That also means that eight houses sell every minute in this country.

Again, I put the math here on the picture. You take that 11,000 number and divide it by 24 hours, 467 every hour. Divide that by 60, 7.8 homes sell every minute.

Remember, as we see panic subside, we see better mortgage rates!

You may benefit from alternative means of financing. I think that's critically important right now.

Adjustable-rate mortgages and rate buydowns, a 2-1 buydown or a seller concession that's applied to a buydown is very, very advantageous for those looking to buy right now.

And here’s a couple of quotes on that as we think about that.

First, from the Urban Land Institute, they say, "The risk of ARMs, adjustable-rate mortgages, were substantially mitigated by the regulatory reforms put in place after the 2008 bust. Today's adjustable-rate mortgage is not the risky products of 2008 or even the pre-bubble version.

ARMs are no longer something to fear. In fact, they could help borrow or save money and reduce barriers to homeownership.”

So you need to have to great Realtors and lenders working together on your side.

If you think about rate buydowns, this comes from Real Estate News,

"Temporary rate buydowns are a hot trend for mortgages as borrowers face higher costs for home loans. Some buyers are exploring alternatives to traditional mortgages in a period of rising interest rates that is expected to continue into 2023. Buydowns are a less costly alternative to a traditional fixed rate mortgage

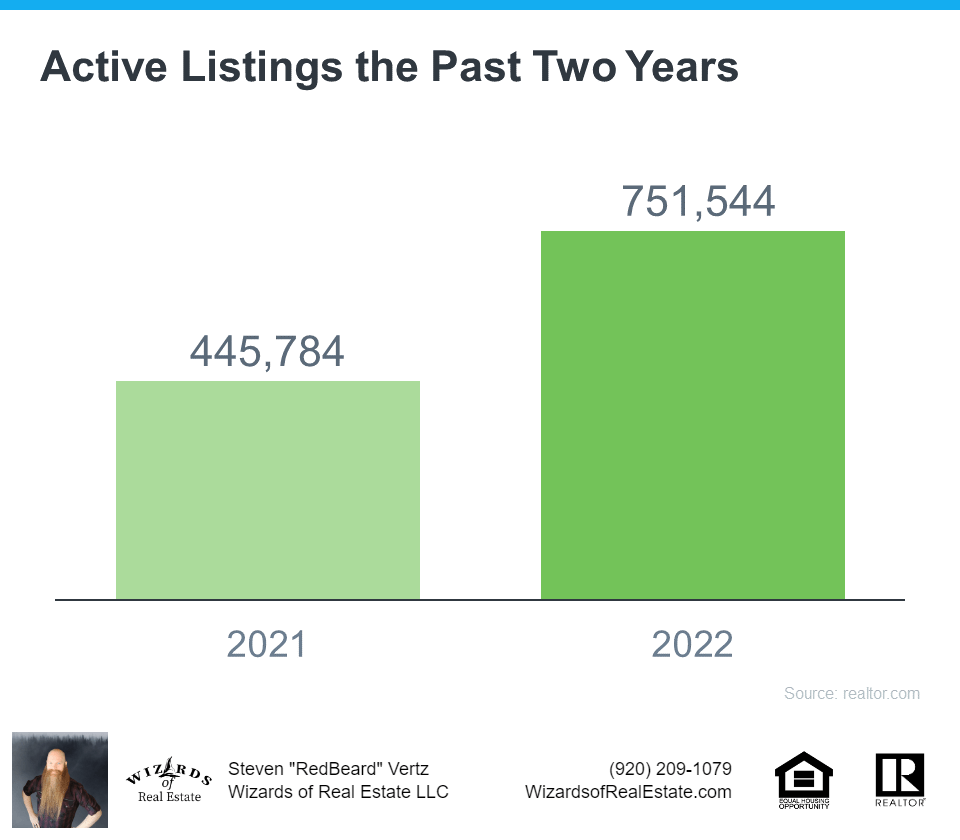

I want to break it down this way: as you start to look at information in the data that's out there, one thing becomes true, active listings over the past two years have grown. We wrapped up 2021 with just about 450,000 active listings in this country. We wrapped up 2022 with just about 750,000 listings. So that's the first point. We have more listings today.

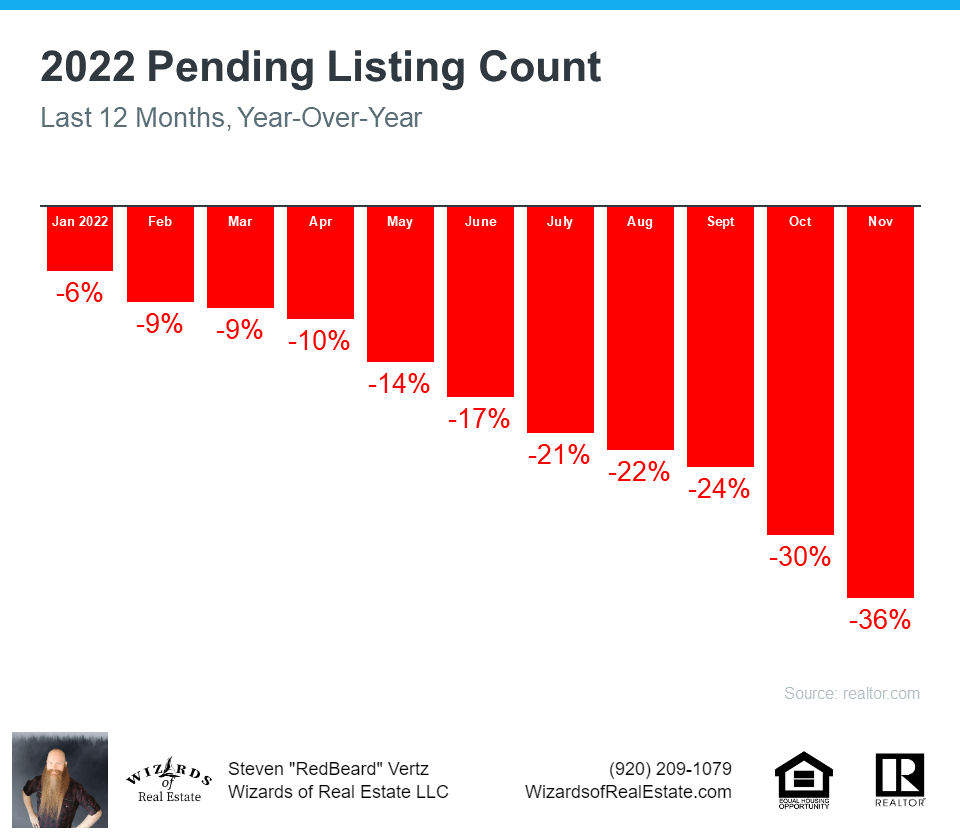

But what do we also know? Pending listings have decreased every month since the beginning of last year. They were stable month over month from February to March, but each month have trickled down. Meaning, pending listings is an indicator of velocity and demand in the market. So if they're less pending listings, that means less sales. So you have inventory increasing… pending or demand decreasing.

What does that mean? We may see more expired listings if the trend continues, but the spring market around the corner and it always brings in more buyers…and this will be another great army if interest rates drop again.

As always, we are grateful for you investing this time into understanding what this market shift entails. Be the informed buyer or seller in this market…and be sure to follow me on the socials…as I will have an updated video about the market in the next couple weeks too.

Until Next time my friends, RedBeard out!

Steven M Vertz

Wizards of Real Estate LLC

(920) 209-1079

Post a comment