We're in a time right now where there are a lot of questions, a lot of concerns, and a lot of uncertainty.We started off the year sort of seeing good buyer demand and good activity in the market. Interest rates dipped down into the fives, but bad economic news and inflation came with the higher rates, and we are currently hovering around 6.5-7%.

Sam Khater from Freddie Mac said, "The economy is showing signs of resilience, mainly due to consumer spending and rates increasing. Overall housing costs are also increasing and therefore impacting inflation, which continues to persist."

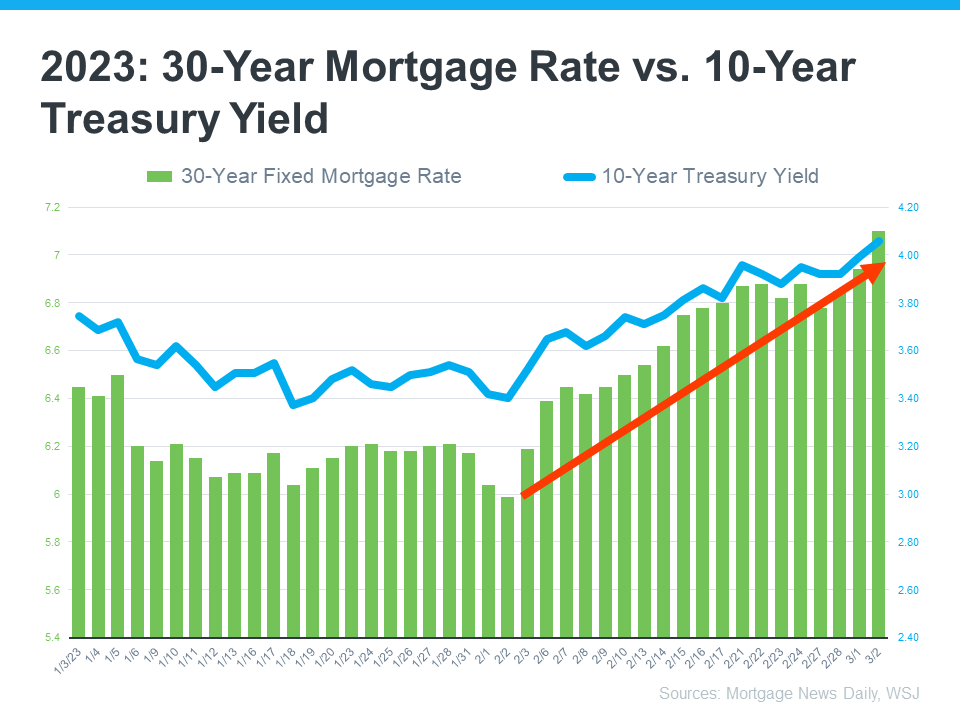

Over the last 50 years, the 30-year mortgage rate has moved in unison with the 10-Year Treasury. (03:28)

We know that the spread between the 10-Year Treasury and the 30-year fixed has widened. As I said in the last video, the average spread is 1.7%. However, the average spread going back to the first of this year was at 2.7%

Housing inventory is the main issue we face. We will get through this interest rate challenge, that is for sure, but the even bigger challenge is inventory.

Covid appeared and recreated the meaning of home. Businesses shut down, more and more people started working in their homes, kids were forced to stay home for school, and everything else revolved more around the home.

Interest rates sank to around 2.75%, and armies of people jumped in and said, "Now we're going to buy a house.” This started to deplete inventory across the country and fueled this market that we've seen over the last couple of years.

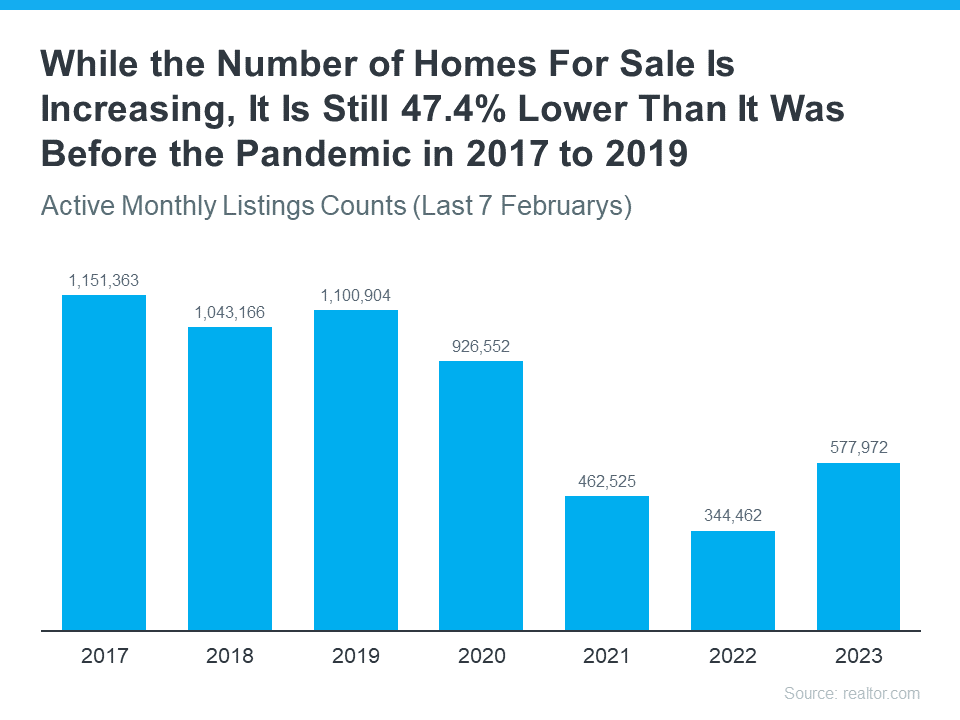

Inventory rises, but it is still below where it was in 2019. This graphic from realtor.com shows the active monthly listings in the last seven Februarys.

You see 577,000 active listings in February of this year compared to over a million almost in the years prior to the pandemic. So there is significantly less inventory across the country, and we know we need more. That's a bigger issue than interest rates.

Inventory is down about 6% January over February most recently. most states are between zero and 15% down across the country. about everywhere seeing less inventory relative to what they saw the month prior.

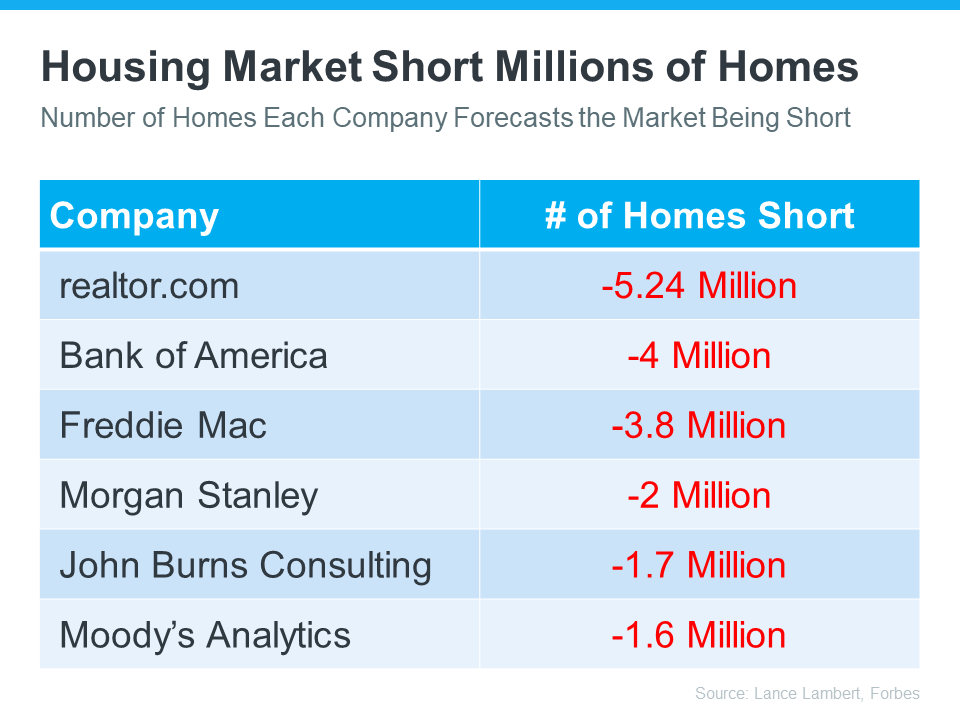

the lack of inventory in this country has kept upward pressure on prices. That's the reason things haven't spiraled out of control like we saw in 2008, where it was a strong buyer's market and inventory was very high. And this graphic here, shows that the fact that for 14 straight years we've been below the 50-year average in the number of units brought to market.

So when you have 14 straight years of lack of building homes, then you end up with a deficit. Everybody rushes in during Covid due to low interest rates. You don't have the available inventory, and that causes prices to spike.

All forecasters say that there is not enough homes on the market for the number of people that want to buy them.

Should you buy a home if the interest rates are higher and you have to go into a bidding war?

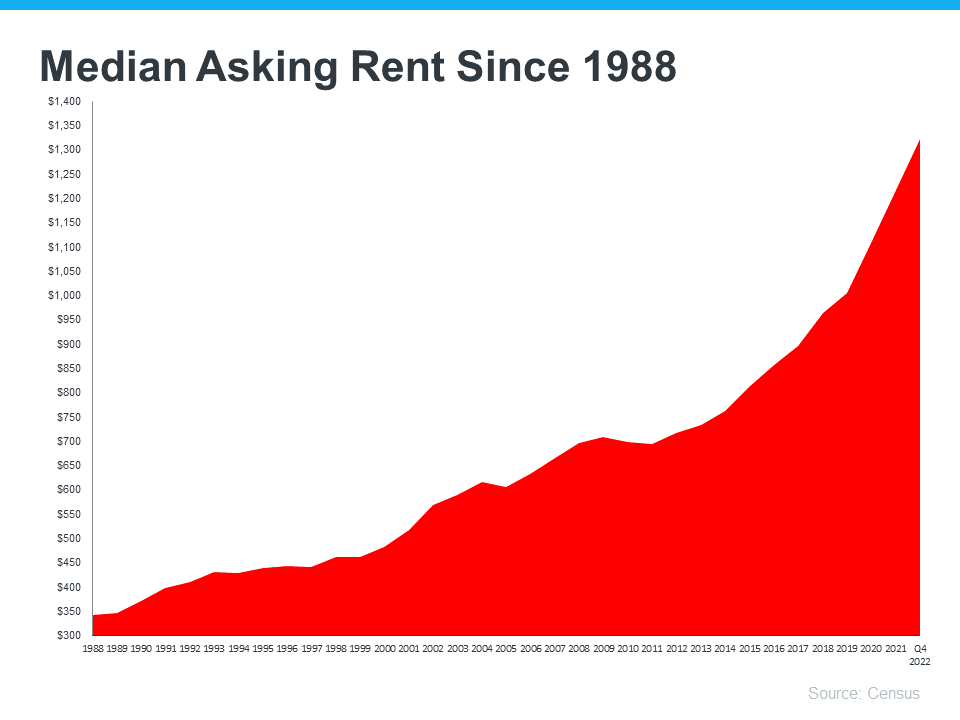

Keep in mind that rent always goes up, but most homes gain value and continue to build equity over time.

This graphic right here shows a median asking rent since 1988. It's always gone up. You know what I am talking about if you are a current renter. Rent has gone up dramatically. When you buy a home, your mortgage payment remains fixed. you can bring stability to the largest expense of your household budget.

Now…

If you wait for prices, you wait for interest rates to come down, what do you think everybody else is going to do? It's almost like Black Friday at Walmart, you ain't getting in. And you're getting in a fight. That's the bottom line.

If you go back the last 30-years, the

average appreciation in this country, almost 300%, 289% at home prices. So we can say

confidently, homes go up in value, rents always go up. You can secure your payment, your

housing payment through buying a home, and it's an appreciating asset, okay? So rents

always go up. Prices go up. And what does that lead to? The third point here, is that owning a home becomes a builder

of equity!

Post a comment