How Much is Your Fox Cities Home Worth: You Might Be Surprised by the Answer

Let's discuss an item that you may not review as frequently as your bank account: the market value of your Fox Cities, Wisconsin property. However, regarding your financial circumstances, it is crucial to keep this information in mind. When was the last time you had a professional Realtor assess the value of your Fox Cities, WI home?

Let’s take a closer look at this topic. For most people, their home is their most valuable item. And if you've had your home for a few years or longer, it's likely been quietly making you money in the background. In all honesty, you might be surprised by the amount of money it generates. You might be shocked at how much.

Home Equity: What Is It?

Home equity is the source of this wealth, which you may not even be aware you possess. Home equity is the difference between your home's value and your mortgage balance. As house values increase and you make monthly mortgage payments, your home equity gradually increases. For a better grasp of the concept, consider the following example.

Let's say the current value of your home is $400,000, and you have $200,000 left on your loan. This scenario implies that you have $200,000 in equity. Additionally, the majority of homeowners (including those in the Fox Cities and surrounding areas) are currently resting on substantial equity.

Cotality (2024 - previously CoreLogic) estimates that the average mortgage-holding homeowner (U.S. based) has roughly $311,000 in equity.

Why You Most Surely Have More Than You Know

The two main reasons homeowners just like you have record levels of equity right now:

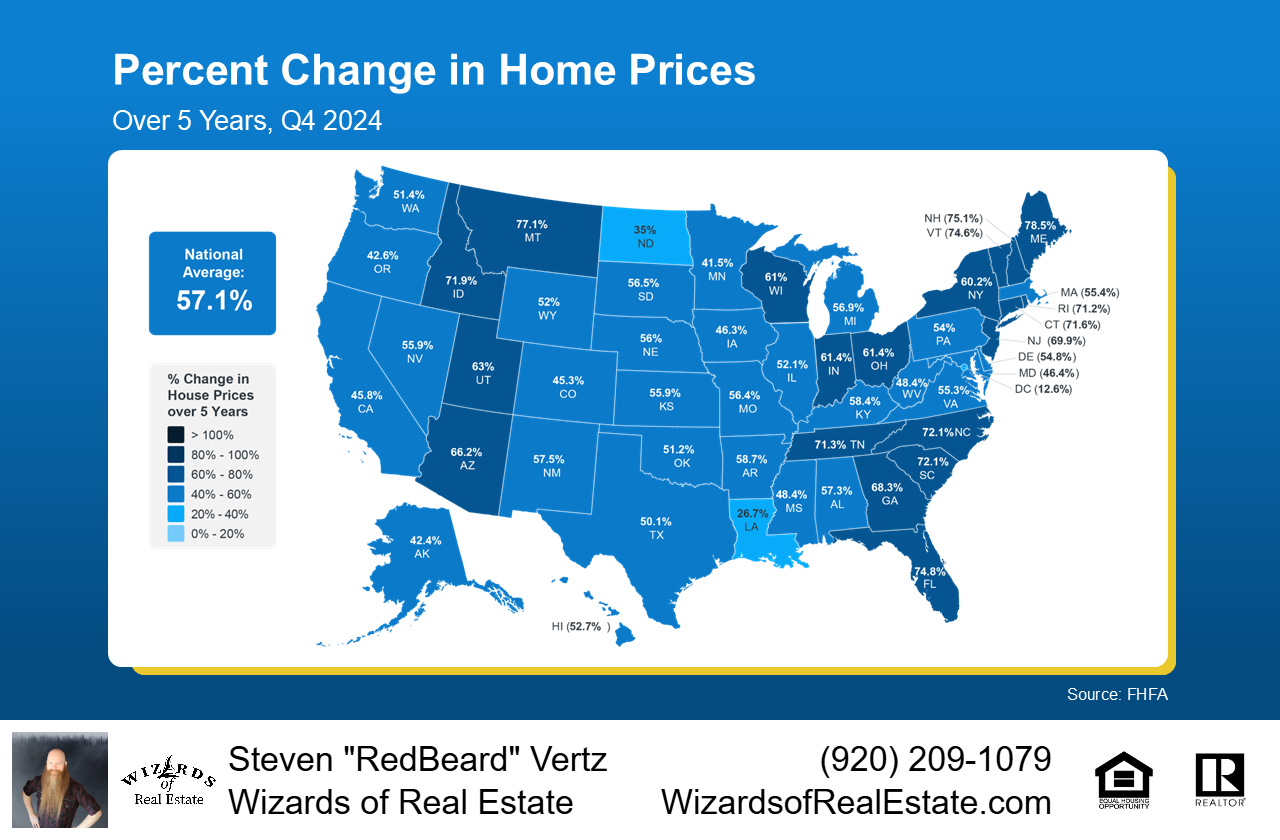

1. Notable Increase in Home Price. Over the past five years, housing prices have surged by more than 57% nationally, according to the Federal Housing Finance Agency (FHFA House Price Index® Datasets | FHFA, 2025; see map below):

And if you bought your home more than a few years ago, it's probably worth a lot more now than it did when you bought it. This is due to the significant increase in prices in recent times.

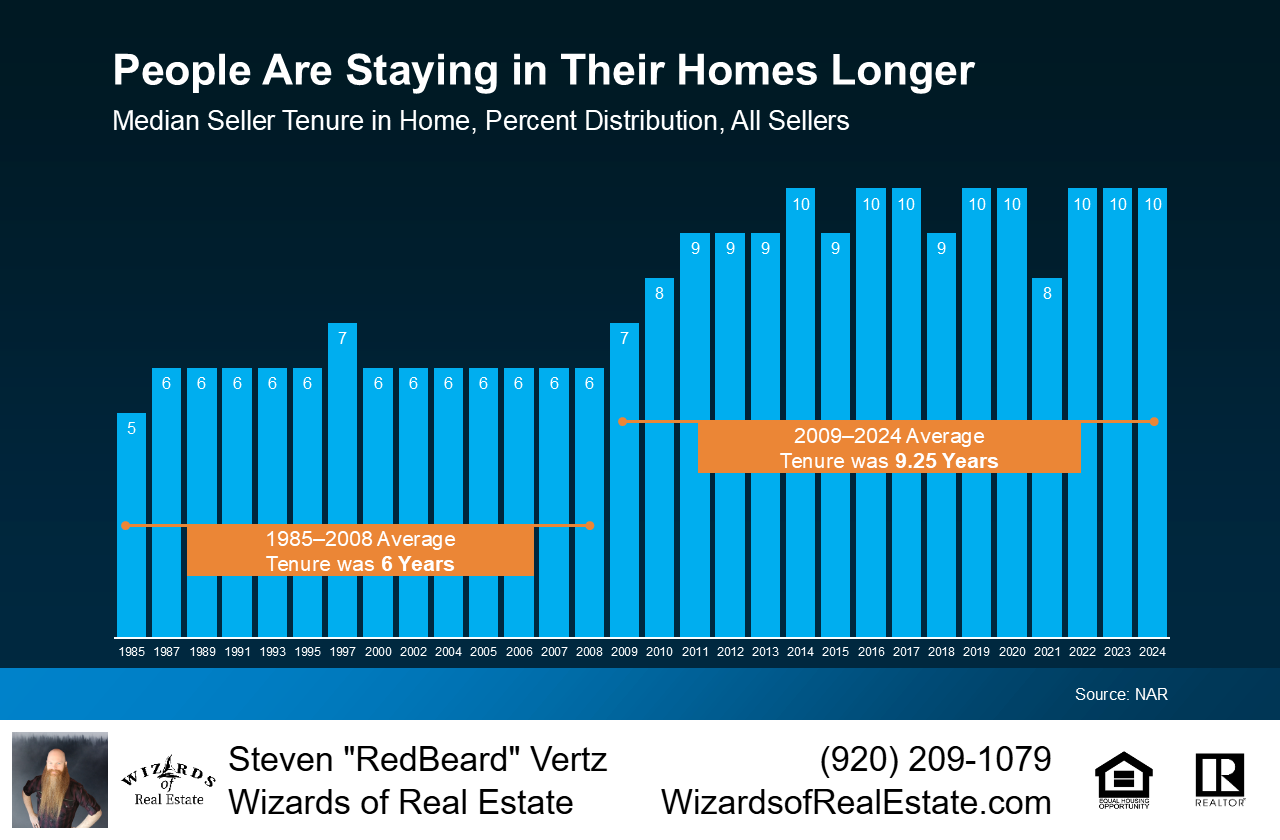

2. People stay in their homes longer. Statistics from the National Association of Realtors (NAR, 2024) show that most people stay in their home for about 10 years (see graph below):

It's longer now than it was before. Over those ten years, what progress have you made? By paying off your debt and taking advantage of your home's increasing value, you have built equity.

If you've lived in your home that long, here's how much the price growth behind the scenes has helped you, per NAR (2024):

"The average homeowner has gained $201,600 in wealth over the past ten years just from home prices going up."

What are you able to do with that equity?

Keep in mind that your home may be your most valuable asset. If you're smart about how you use your equity, it could give you some great future opportunities.

-

It can help you buy a new home. The money you saved up could help you pay for the down payment on your next home. Sometimes, it could even mean that you can pay cash for your next home.

-

Consider enhancing your current home to better accommodate your needs. If you plan your home projects well, they may even increase your home's value when you sell it.

-

Start that business you have always wanted. Your home’s equity could be exactly what you need for marketing, equipment, or startup funds. This would not only increase your earning potential but also provide an additional financial advantage.

Some Final Thoughts

Your house is probably worth far more than you could possibly know. Your equity is more than just a figure whether your plans call for selling, improving, or just understanding your possibilities. It is a tool.

Should you sell your house and have substantial equity to deal with, what would you do? Let's work on converting the value of your house into your next major purchase.

Call/Text (920) 209-1079 to learn more about your home equity!

~ Steven M Vertz, Realtor

Owner-Operating Real Estate Broker of Wizards of Real Estate

References

Cotality. (2024, December 6). Retrieved April 24, 2025, from https://www.cotality.com/press-releases/corelogic-us-homeowners-see-equity-gains-drop-by-more-than-5-percent-in-q3

FHFA House Price Index® Datasets | FHFA. (2025, March 31). FHFA.gov. Retrieved April 24, 2025, from https://www.fhfa.gov/data/hpi/datasets?tab=hpi-summary-table

National Association of REALTORS®. (2024, November 26). A decade of soaring home prices: where affordability still thrives. Retrieved April 24, 2025, from https://www.nar.realtor/blogs/economists-outlook/a-decade-of-soaring-home-prices-where-affordability-still-thrives

National Association of REALTORS®. (2024, November 4). Highlights from the profile of home buyers and sellers. Retrieved April 24, 2025, from https://www.nar.realtor/research-and-statistics/research-reports/highlights-from-the-profile-of-home-buyers-and-sellers

#homeequity #housevalue #housevalues #homevalue #appletonhousevalues #appletonwi #appletonwisconsin #foxcities #foxcitieswi #foxcitieswisconsin

Post a comment