Mortgage Forbearance: A Beneficial Choice for Homeowners Dealing with Difficulties

Wednesday Jan 08th, 2025

Mortgage Forbearance: A Beneficial Choice for Homeowners Dealing with Difficulties

Let's face it: unexpected things happen in life. Anybody can experience financial difficulties, whether it's due to a natural disaster, unanticipated bills, or a loss of employment. Here's the good news, though. Mortgage forbearance is a lifeline for homeowners who are struggling financially, and many people are unaware it is still accessible.

Mortgage Forbearance: What Is It?

As explained by Caginalp (2024) at Bankrate:

“Mortgage forbearance is an option that allows borrowers to pause or lower their mortgage payments while dealing with a short-term crisis, such as a job loss, illness or other financial setback . . . When you can’t afford to pay your mortgage, forbearance gives you a chance to sort out your finances and get back on track.”

Life happens, and unexpected challenges can make keeping up with mortgage payments tough. But here’s the reassuring truth: most homeowners are in a strong position, and forbearance continues to work as a helpful safety net for those facing temporary hardship.

There are many who believe that forbearance was not available outside of the COVID-19 epidemic. Although forbearance was crucial in helping homeowners get through that crisis, many people are unaware that it can still be used to help borrowers in difficult circumstances. It is still an essential choice today to assist homeowners in specific situations in avoiding delinquency and, eventually, foreclosure.

The Mortgage Forbearance Situation Right Now

Forbearance is still a great way for people who are having short-term money problems to get some extra help. Recently, there has been a small rise in the general rate of forbearance (Taylor, 2024). It's important to know why this is happening and how it fits into the bigger picture.

Taylor (2024) shared that Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA), said the following:

“The overall mortgage forbearance rate increased three basis points in November and has now risen for six consecutive months.”

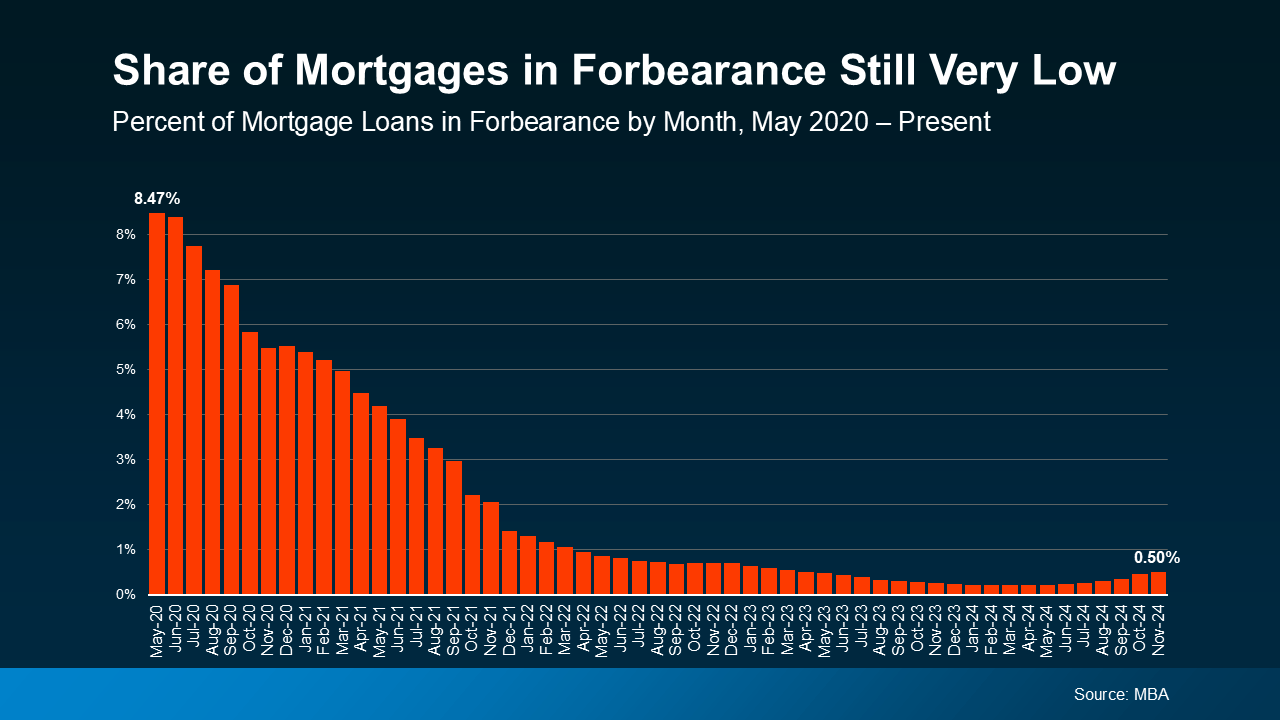

At first look, this can appear alarming, but let's examine it more. The following graph, which stretches back to 2020, provides context:

There has been a minor but noticeable increase in the percentage of mortgages in forbearance in recent months, despite the fact that it has drastically decreased since peaking in mid-2020. The impacts of two recent hurricanes, Helene and Milton, are mostly to blame for this increase (Taylor, 2024).

Forbearance is an essential safety net during recovery since natural disasters like these frequently cause homeowners to experience short-term financial challenges. Indeed, 46% of current forbearance borrowers attribute their financial difficulties to natural disasters (Taylor, 2024).

Despite the current increase, the percentage of mortgages under forbearance is still well below epidemic levels and, fortunately, only represents a very small percentage of all homeowners.

The Significance of Forbearance

Borrowers can avoid the cycle of late payments and foreclosure by requesting forbearance. It provides you with the necessary time to address issues and formulate future plans. Forbearance is an option for the few who do require it, even if the majority of homeowners today are not in a position to require it because of the solid equity and foundations of the current housing market.

If you or someone you know owns a home and is going through some financial difficulty, you should first talk to your mortgage company. They can explain the forbearance process and help you decide what to do. Remember that forbearance doesn't just happen; you have to ask for it and talk to your lender about the terms.

In Conclusion

Being aware of your options can help you feel more at ease during difficult situations. Forbearance is a lifeline, not merely a financial tool. Furthermore, even if the recent rise in forbearance rates may make you uneasy, the fact is that this option is doing just what it should—assisting those who are most in need of it in overcoming adversity without losing that place they call "home."

References

Caginalp, R. (2024, October 28). Mortgage forbearance: What is it and how does it work? Bankrate. https://www.bankrate.com/mortgages/everything-you-should-know-about-mortgage-forbearance/#what-is

Taylor, F. (2024, December 23). Share of mortgage loans in Forbearance increases to 0.50% in November. MBA. https://www.mba.org/news-and-research/newsroom/news/2024/12/23/share-of-mortgage-loans-in-forbearance-increases-to-027-percent-in-july

Post a comment