The Three Factors Affecting Home Affordability Today

There has been a great deal of attention on the impact of rising mortgage rates on the affordability of homes for today's purchasers. It is true that rates have substantially increased since the pandemic-era record lows. But home affordability is determined by a combination of mortgage rates, property prices, and wages.

Considering how each of these factors is evolving provides a complete picture of the current state of home affordability. Here is the most recent information.

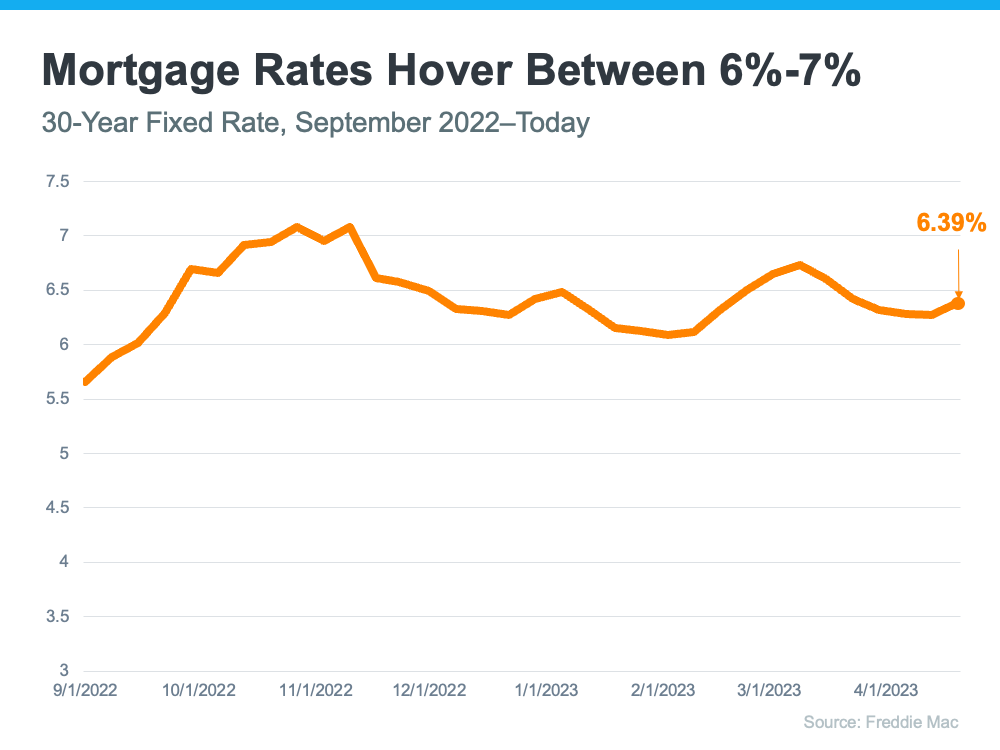

1. Mortgage Rates

Despite being higher than they were a year ago, mortgage rates have been mostly fluctuating between 6% and 7% for the past nearly eight months (see my prior videos and see graph below):

The graph demonstrates that there has been some fluctuation in mortgage rates over that time. Your ability to make purchases is impacted by even minor changes in mortgage rates. To stay informed about what's going on in the market, it's crucial to rely on your team of real estate experts for advise. Although it's difficult to predict where mortgage rates will go from here, most analysts agree that they'll probably stay between 6% and 7% for the foreseeable future. I do believe we will see rates periodically drop into the 5% and 6% range for some borrowers (depending on a multitude of factors), but don't wait too long...as home prices continue to climb.

2. Home Prices

The record-low mortgage rates we had during the pandemic caused a surge in buyer demand, which resulted in a dramatic increase in property prices during the past few years. Due to the imbalance between the increased buyer demand and the historically low supply of available homes for sale, housing prices rose. However, the rate of price growth has moderated because to the higher mortgage rates of today.

Additionally, home price growth differs by market. While costs are rising in certain locations, they are slightly declining in others. According to Selma Hepp, Chief Economist at CoreLogic:

“The divergence in home price changes across the U.S. reflects a tale of two housing markets. Declines in the West are due to the tech industry slowdown and a severe lack of affordability after decades of undersupply. The consistent gains in the Southeast and South reflect strong job markets, in-migration patterns and relative affordability due to new home construction.”

Contact a trusted real estate agent to learn more about the price trends in your neighborhood, and as always, I am happy to help!

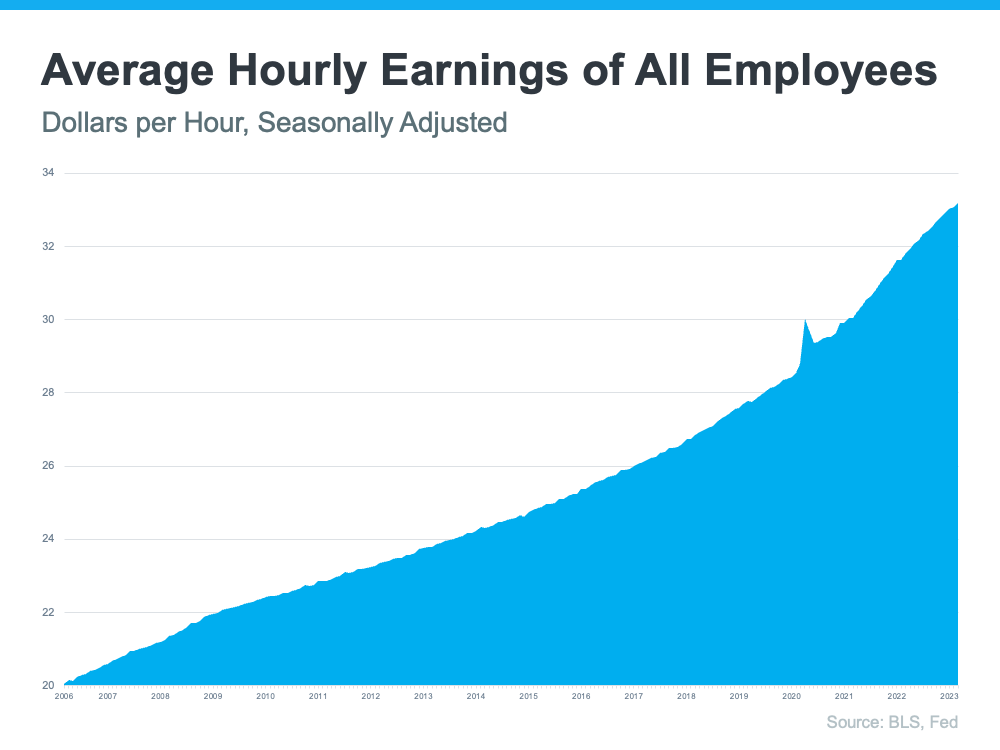

3. Wages

Currently, the most beneficial factor for affordability is rising income for would be home buyers. The graph below utilizes Bureau of Labor Statistics (BLS) data to illustrate wage growth over time:

Higher wages increase housing affordability because they reduce the proportion of your income required to pay your mortgage, as you spend less of your paycheck on monthly housing costs.

The affordability of housing is determined by a combination of rates, prices, and earnings. If you have quesitons or would like more information, you should contact a real estate professional who can explain what's happening locally and how these factors interact.

Bottom Line by Wizards of Real Estate LLC

In order to make an informed decision when purchasing a home, it is essential to be aware of the main factors that affect affordability. Let's communicate now in order to remain ahead of the housing market and its many moving parts!

Post a comment