Why Mortgage Rates Could Continue To Decline

While reading or hearing about the housing market, you'll come across some talk of inflation or recent choices made by the Federal Reserve (the Fed). But how do those two things change your plans to buy a house? Read this to learn more.

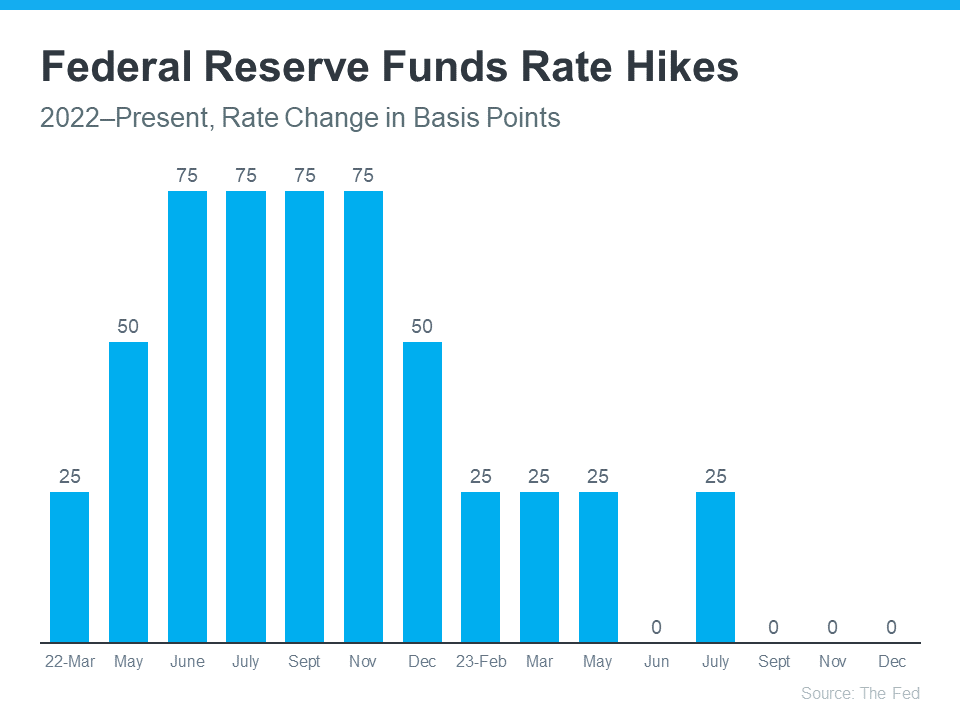

Fed Funds Rate Hikes Have Stalled

Bringing down inflation is one of the Fed's main goals. In order to do that, the Federal Funds Rate was raised to make the economy slow down. This does have an effect on mortgage rates, but it doesn't directly cause them to change.

Inflation has cooled a bit, which means that the rate hikes worked and are now bringing inflation back down. Because of this, the Fed has been raising rates less often and by smaller amounts. There haven't been any increases in the Federal Funds Rate since July (see graph below):

On top of not raising the Federal Funds Rate during the last three committee meetings, the Fed has hinted that rate cuts could be in the works for 2024. In light of what has been reported in the New York Times (NYT):

“Federal Reserve officials left interest rates unchanged in their final policy decision of 2023 and forecast that they will cut borrowing costs three times in the coming year, a sign that the central bank is shifting toward the next phase in its fight against rapid inflation.”

The Fed thinks that the economy and prices are getting better because of this. What does that have to do with your plans to buy a house? It might cause borrowing rates to go down, making homes more affordable.

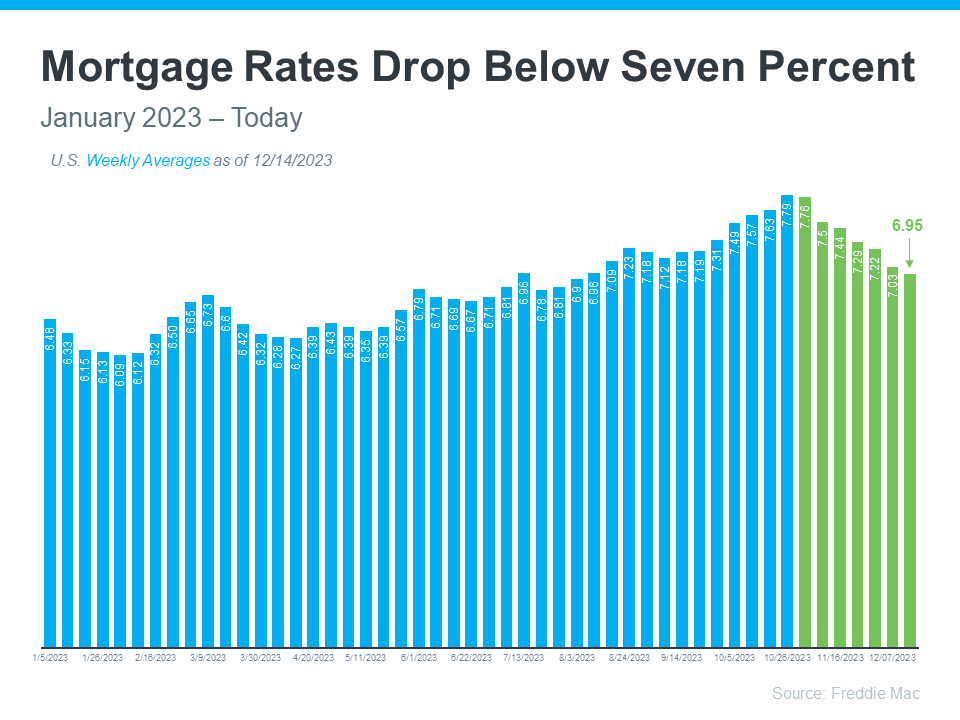

Loan Rates Are Going Down

Mortgage rates are affected by many things, but inflation and the Federal Reserve's actions (or lack of actions, as of late) play a larger role. Now that the Fed has stopped raising rates, it seems more likely that they will keep going down (see image below):

Mortgage rates may still bounce up and down, but based on their recent trend and predictions from experts, they may continue to go down in 2024. That would make it easier for sellers to move because they won't feel as tied to their current low mortgage rate. It would also make it easier for buyers to afford to buy.

In Conclusion

Mortgage rates are affected indirectly by Fed actions. Mortgage rates are projected to fall further due to the Federal Funds Rate not being raised. Let's talk so you can get expert guidance on property market changes and how they affect you.

Post a comment