Why Today’s Housing Market Is Not About To Crash

Some people are worried that the home market is going to crash soon. And it's easy to see why this worry has come up, given how hard it can be to buy a house and how much the media talks about the possibility of a recession.

But the numbers show that the market is very different now than it was before the 2008 housing crash. Don't worry, this is not the same thing that happened back then. This is why.

Loans Are Harder To Get These Days

Before the housing problem of 2008, it was much easier to get a mortgage than it is now. Back then, banks had different rules about who they would give money to. This made it easy for almost anyone to get a home loan or refinance one they already had. Because of this, lending institutions took on a lot more risk, both with the person and with the mortgage products they gave. That led to a lot of failures, foreclosures, and prices going down.

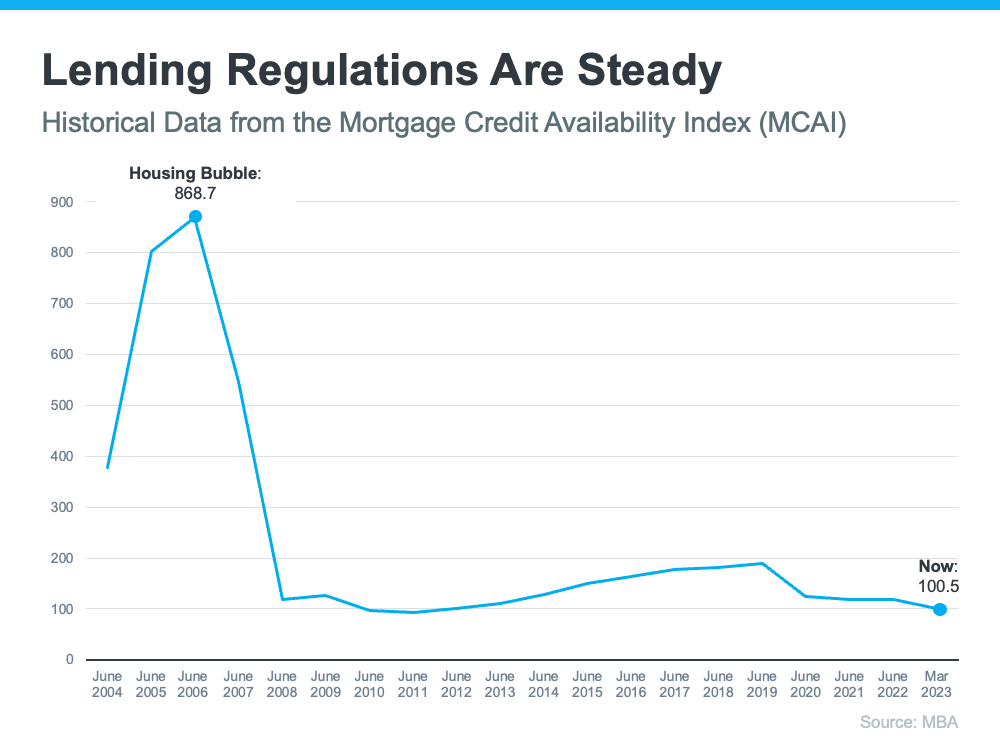

Things are different now because credit companies have stricter requirements for buyers. This difference is shown in the picture below, which is based on data from the Mortgage Bankers Association (MBA). When the number is low, it's harder to get a credit. The number tells you how hard it is.

Faster Unemployment Recovery

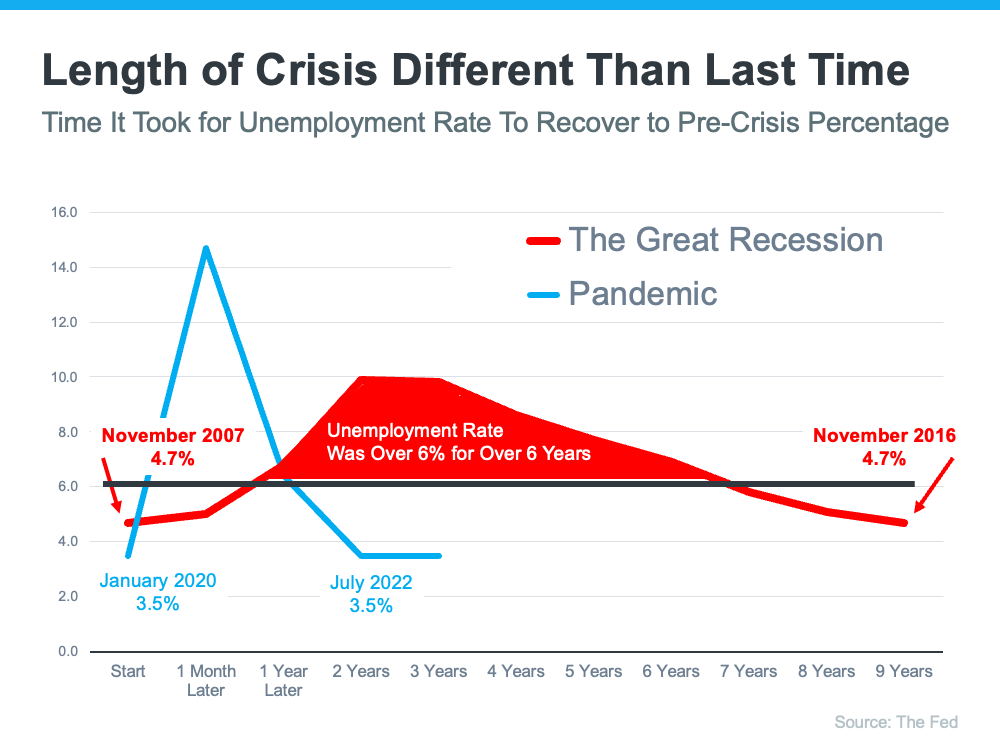

Even though the pandemic led the unemployment rate to go up in the last couple of years, it has already gone back to where it was before the pandemic (see the blue line in the graph below). During the Great Recession, things were different because a lot of people were out of work for a much longer time (see the red in the curve below):

Here's how the housing market benefits from the fast job rebound this time. Better employment means there is less chance that a homeowner will fall on hard times and not be able to pay back their loan. This helps the home market get back on its feet and makes it less likely that there will be more foreclosures. Most homes also have plenty of equity in this hot market, which allows a homeowner to sell and avoid foreclosure as well!

There Are Less Home on the Market Today!

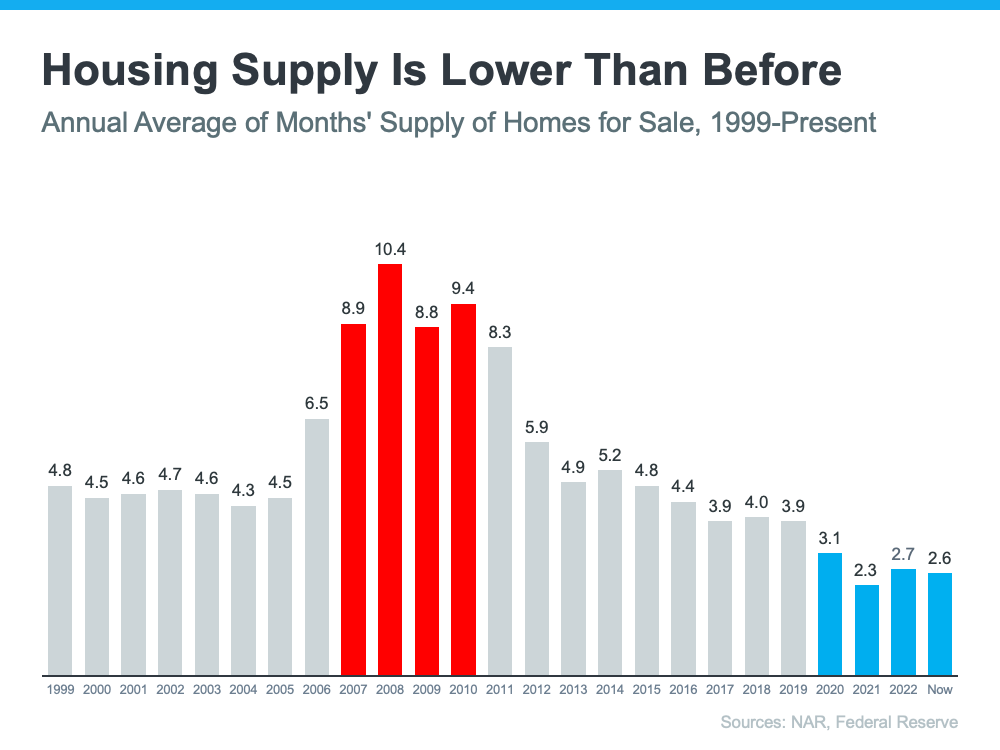

During the housing crisis, there were also too many houses for sale, and many of them were short sales or foreclosures. This caused home prices to fall. Overall, there aren't enough homes on the market right now, which is mostly due to years of underbuilding.

The graph below uses statistics from the National Association of Realtors (NAR) and the Federal Reserve to show how the months' supply of homes now compares to the crash. Today, the housing inventory sits at around only 2.6 months of supply. There aren't enough houses on the market for home prices to fall like they did in 2008.

Nearly Record High Equity Gains

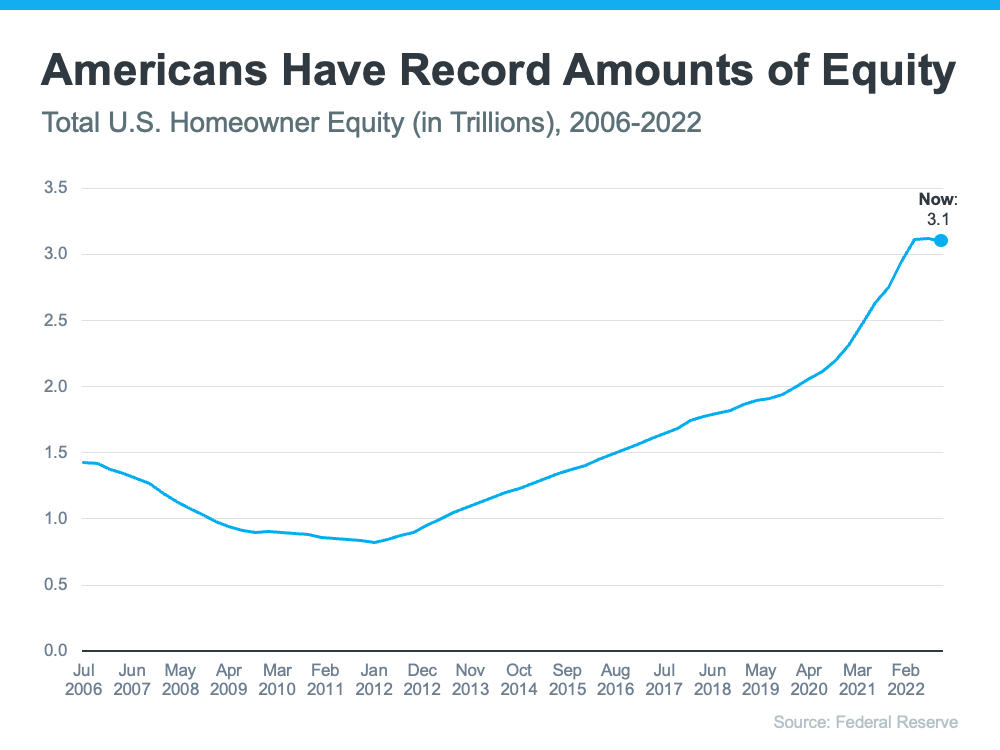

During the outbreak, home prices kept going up because there weren't many houses for sale. As a result, homeowners have near-record amounts of wealth (see graph below):

And that wealth makes them much better off compared to than the Great Recession. The Chief Economist at CoreLogic, Molly Boesel, says:

“Most homeowners are well positioned to weather a shallow recession. More than a decade of home price increases has given homeowners record amounts of equity, which protects them from foreclosure should they fall behind on their mortgage payments.”

More than a decade of rising home prices has given homeowners record amounts of equity, which saves them from foreclosure if they fall behind on their mortgage payments.

Bottom Line by Wizards of Real Estate LLC

The figures above should calm your fears that the housing market today is about to crash. The most recent data makes it clear that the market today is nothing like it was before.

Post a comment