Mortgage Rates: Past, Present, and Possible Future

You're likely paying close attention to mortgage rates if you want to buy a house this year. It's worth taking a look at where mortgage rates have been in the past and how they compare to where they are now because they affect how much you can afford when you get a home loan. This is especially important now when it comes to cost. Aside from that, it's important to know how they relate to inflation to get a sense of where mortgage rates might go soon.

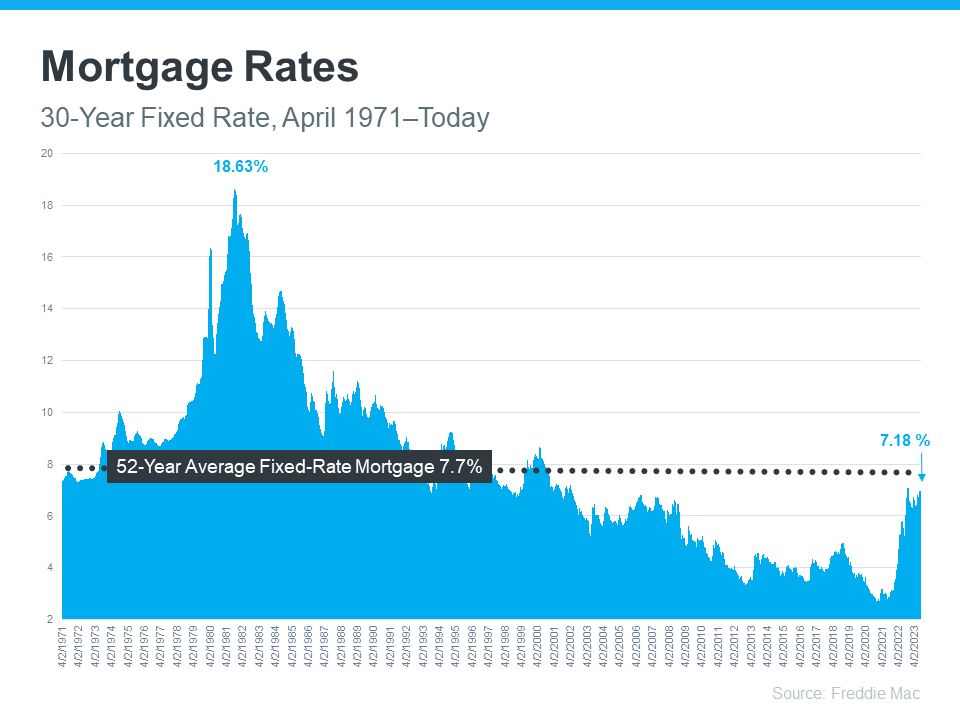

Since April 1971, Freddie Mac has kept an eye on the 30-year fixed mortgage rate. They share the results of their Primary Mortgage Market Survey every week. This survey takes the average of mortgage application data from lenders across the country (see graph below):

Mortgage rates have gone up a lot since the beginning of the year, as shown on the right side of the graph. But rates are still lower than they were 52 years ago, even after that rise. That historical background is helpful, but buyers are used to mortgage rates being between 3% and 5%, since that's what they've been for 15 years.

That's important because it explains why the recent rise in rates might have made you feel like the prices are too high, even though they're still close to their long-term average. Even though many would be buyers have gotten used to seeing the higher rates of the past year, a little drop in rates would be nice. It's important to look at inflation to see if that's a real option.

How much could mortgage rates go up or down in the future?

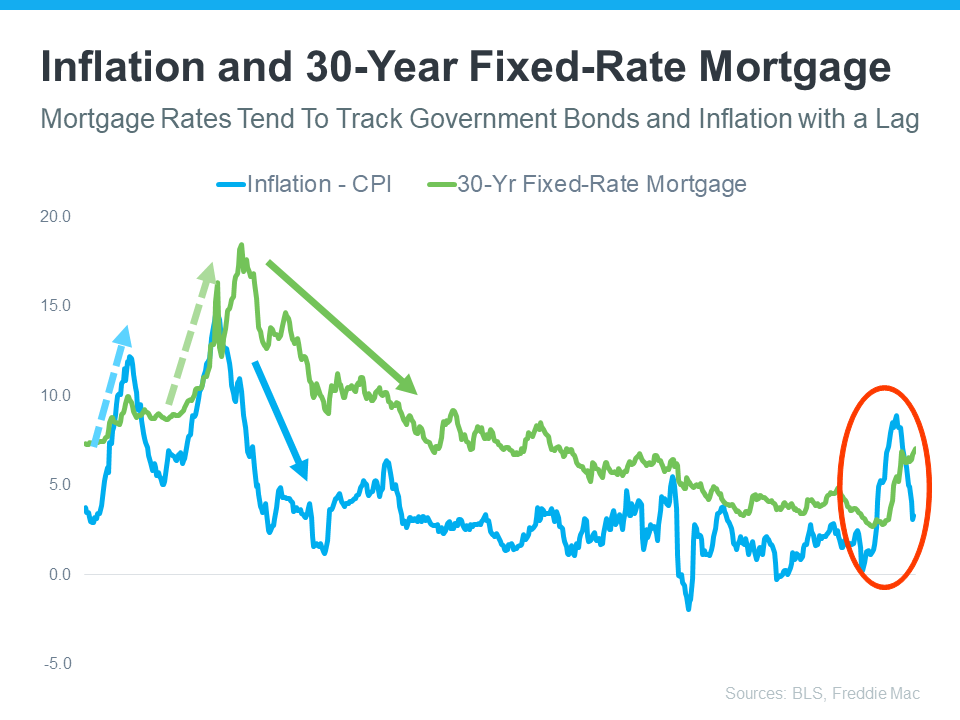

Since the beginning of 2022, the Federal Reserve has been working hard to bring down inflation. This is important because there has always been a link between inflation and mortgage rates (see picture below):

Inflation and mortgage rates appear to correlate rather well, as depicted by this graph. As you can see on the left side of the graph, mortgage rates (green) tend to follow large shifts in inflation (blue).

The correlation between mortgage rates and inflation is rather consistent, as this graph demonstrates. Looking at the left side of the graph, mortgage rates (shown in green) fluctuate in lockstep with substantial movements in inflation (shown in blue).

The graph's circled area indicates the location of the most recent surge in inflation, closely followed by mortgage rates. This year, inflation has somewhat decreased, but mortgage rates haven't changed in line with it yet.

Based on historical data, it may be inferred that the market is anticipating a decline in mortgage rates due to inflation. Although it is impossible to pinpoint with certainty where mortgage rates will wind up, decreasing inflation suggests that a decline in rates in the near future would be consistent with a long-standing pattern.

To Sum It Up

It's helpful to examine past mortgage rate trends in order to predict future trends. There's no denying the historical correlation between inflation and mortgage rates; if it continues, the recent decrease in inflation could bode well for mortgage rates going forward and for your aspirations of becoming a homeowner.

Contact us today:

Wizards of Real Estate

(920) 209-1079

redbeard@wizardsofrealestate.com

Post a comment